Lagging consumer confidence means retailers and retail landlords will need to prioritize the consumer experience to drive growth in 2023, according to a report by the retail experts at Colliers Real Estate Management Services.

“Consumer confidence is one of the main indicators of the consumer’s willingness to spend, especially on discretionary purchases. According to Nanos Research, this metric has been declining over the past few months and currently resembles the confidence felt in 2008, during the Great Recession,” says the report.

“In order to see continued sales growth in 2023, retailers and retail landlords must prioritize the consumer experience. The type, quality, and ease of service, along with the range of promotions, and entertainment available, must be tailored to each retailer’s customer base. An enhanced consumer experience also includes sophisticated omnichannel retail, whereby there is harmonious service between all potential points of sale, including in-store and online.”

Adam Jacobs, Senior National Director, Research, Colliers, said the retail industry is experiencing record high sales for this year.

“You could say okay that’s adjusted for inflation, it’s maybe not as high as it looks. But it’s not going down. We’re still at a point where retail is trending upwards. We had the all-time shock to end all shocks during COVID but you know one of the weird silver linings of COVID was we all ended up saving a lot of money and paying off some of our debt and having a little more cash in the bank and we’re kind of reaping that in retail now,” said Jacobs.

“There’s the big pent-up demand they call it or catch up spending. I think this has still been a year that has beat expectations and it’s hard to remember that we’re still in the first year of recovering from lockdowns. I’m in Ontario and it was only eight or nine months ago that we were actually lifting restrictions.

“When we look at the foot traffic measures there’s still an upward trajectory there for a little while longer.”

Jacobs said the e-commerce business was massive during the pandemic but it’s still a little bit behind the US in terms of how built out the sector is.

“E-commerce. There’s still some room to grow there. We’re still a little bit behind some other countries in that area.”

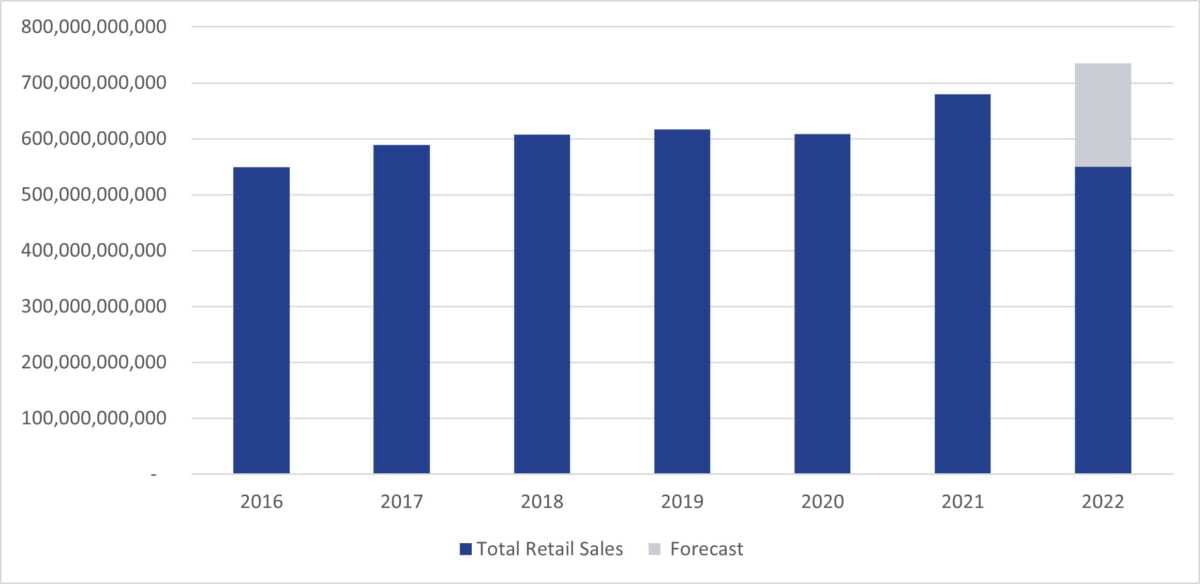

In 2021, total retail sales were the highest on record, reaching $680 billion, said the Colliers report.

“Following what we predict will be a strong holiday season, we expect retail sales to exceed $730 billion in 2022, an increase of seven per cent,” it said.

“E-commerce sales have stabilized at six per cent of total retail sales, falling from the pandemic high of approximately 11 per cent. After a surge in 2020, e-commerce has stabilized at six per cent of total retail sales. This percentage is growing annually, but poses little risk to brick and mortar sales, which are also increasing. E-commerce as a percentage of total retail sales is expected to rise to around 10 per cent by 2025 . . . e-commerce and brick and mortar retail need to be seen as collaborative partners in creating omnichannel retail, where all potential points of sale drive overall growth.”

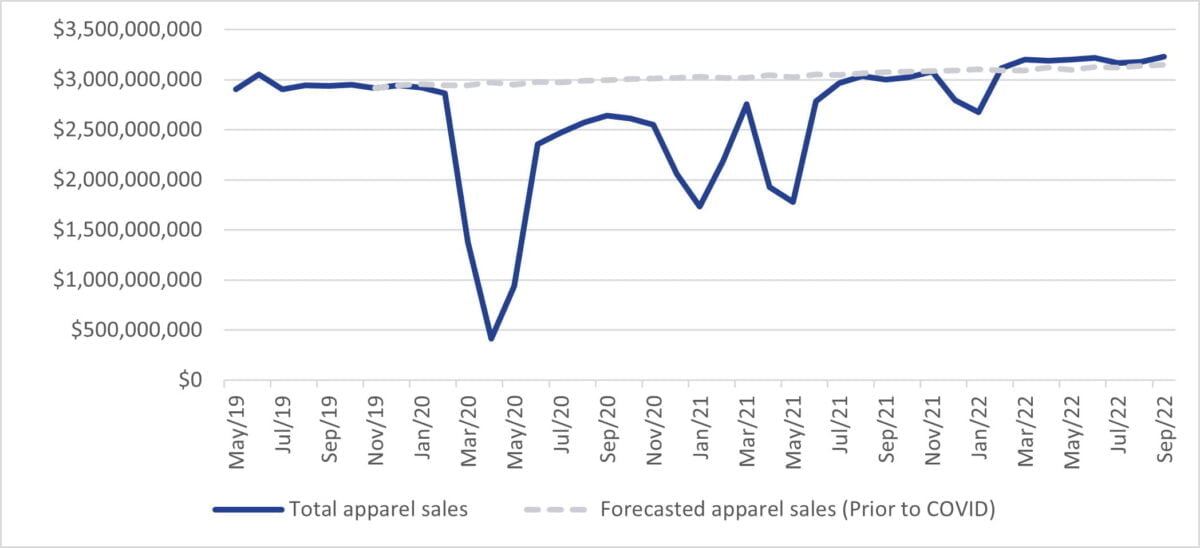

Colliers said apparel is currently among the healthiest retail sectors, with sales in 2022 up 27 per cent compared to 2021. It was one of the hardest hit retail categories between 2020 and 2021.

“As in-person work, travel, and social activities have increased, apparel has seen a comeback. Spending on apparel has increased 27 per cent year to date in 2022 compared to 2021 and 52 per cent compared to 2020. This is particularly good news for enclosed mall owners and tenants, where apparel tends to encompass the majority of their merchandise mix,” it said.

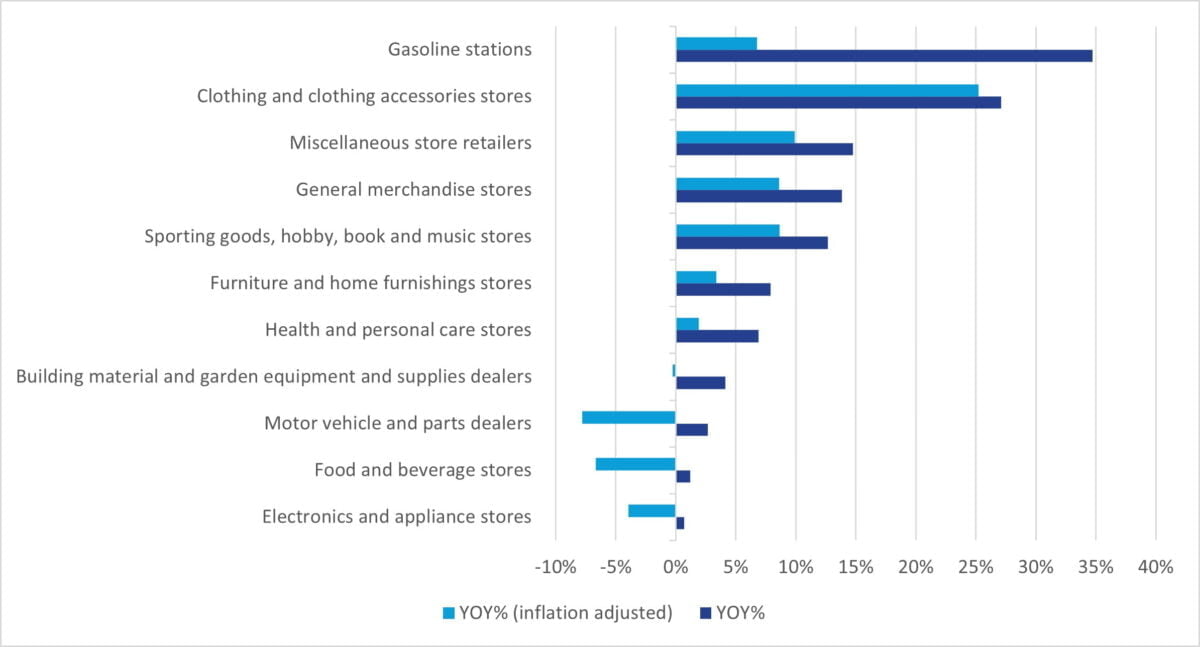

“Inflation is not affecting each category of retail equally, with apparel among the least impacted and gas and groceries among the most impacted.

Total retail sales in 2022 are predicted to increase seven per cent compared to 2021, yet only two per cent when adjusted for inflation. That said, inflation is not affecting each category of retail equally. Apparel is among the least impacted, as a 27 per cent increase in sales year to date becomes 25 per cent when adjusted for inflation. Gas and food are among the most impacted. In 2022 year to date, gas sales rose 35 per cent, but only seven per cent when adjusted for inflation. A one per cent increase in food spending is down (seven per cent) when adjusted for inflation.”

Jacobs said debt is increasing, people are borrowing more and they’re not saving as much.

“So far we haven’t seen that affecting retail sales but there is a possible headwind where people get a little tapped out on borrowing, they feel like they need to save. The thing about inflation is that it’s not evenly distributed,” he said.

But increasing food prices, for example, squeezes people’s budgets.

“One thing we’re seeing, everything related to going back to life in public is back in a big way. Clothes, food and beverage, shoes, entertainment. All of that stuff has been going really strong,” explained Jacobs.